Just waiting for everything to crash

This portfolio takes large companies from a variety of industries with a very favorable dividend.

The higher the percentage yield, the higher the dividend per share. The growth rate % is the best way to gage stocks that consistently return a higher dividend than prior years and indicates strong financial health and sustainable profitability.

*(30-day) means the dividend is paid out monthly rather than annually or quarterly.

The stock market is disgustingly overpriced. A vast majority of companies are trading far above any traditional method of valuation. It has been for a long time, a speculative bubble. It has definitely made the investment community a whole lot of money and it will most likely continue to do so. Following the 2008 Financial Crisis central banks around the world began bailing out corporations and governments with easy money policies. This injection of cash into the economy was meant to be temporary but this strategy has only expanded, especially in recent years. Combined with manipulated interest rates, the debt-based system has made asset prices increase exponentially for past decade and a half.

As long as the US Federal Reserve continues to purchase treasury securities and expand it’s balance sheet (increase the debt) the stock market will receive the monetary heroin it needs to continue higher. Sooner or later the debt market will collapse on itself and potentially lead to a massive stock market crash. This is the general sentiment and thus it will inevitably happen. Although, “experts” have been calling for a crash for YEARS and the market just shrugs off any negative economic news. This will continue to happen as central banks continue to fund the world’s various crisis’s.

Even as the Fed enters a monetary tightening cycle (hiking interest rates) to fight the inflation they themselves created; the markets will still require stimulus to keep the entire financial system afloat. Assets constantly need more and more debt to maintain their current prices. If true price discovery existed based on actual demand, assets prices would need to be cut in half AT A MINIMUM. However, we live in a world where that benefits existing asset holders at the expense of younger and poorer individuals. I don’t believe this sentiment will end anytime soon. In the end, the powers that be would rather sacrifice the strength of the currency over the perceived value of assets. This is the way of the world.

I will continue to be bullish on stocks until the 10-year yield experiences insane volatility and spikes upward in a sporadic fashion. When that happens, we will run for the hills and build a large cash position and wait for the implosion. This bull run will end in euphoria as the melt up sucks in retail investors before crashing to multiyear lows. Do not get left holding the bag! This market is not for everyone, be safe, and don’t forget to have fun.

Current Outlook: The stock market is back at all-time highs. It is quite evident that the current financial system is held up by manipulation and currency debasement. We are now a controlled economy that has nationalized its markets for the benefit of corporations and Wall Street. Thus, stocks will continue higher until the band stops playing (the Fed is abolished, and the criminal bureaucrats are imprisoned). Regardless, the market is in the middle of a “Fed pivot” meaning they expect central banks to return to the easy money environment that pumped stocks to insane highs. The Fed continues to inform the public that they are attempting a “soft landing” where they ease fiscal policy without forcing the economy into recession. The Federal Reserve has proven that they are either inherently inept or willfully incompetent in the fight against the inflation that they themselves created. As the Fed begins to cut rates, volatility is expected. This is a great trading opportunity as volatile market will swing wildly in either direction. Also keep in mind that stocks typically outperform during election years. Despite poor earnings, stock prices could definitely hold up for the next 2-3 quarters. Be wary of melt-ups, this is the time to de-risk in preparation for a crash.

Long-Term Outlook: I cannot confidently hold a large amount of stocks for the long-term. While commodities are gearing for a multiyear bull cycle, stocks are coming to the end of their run. At some point we see a massive crash and it will be an incredible buying opportunity. Until that time I will hedge my portfolio with Large Capitalization stocks with a decent dividend yield. This primarily includes companies in the banking, energy and tech sectors. These stocks will hold up much better in uncertain times.

RUSSELL RECONSTITION 2023 & 2024

Background

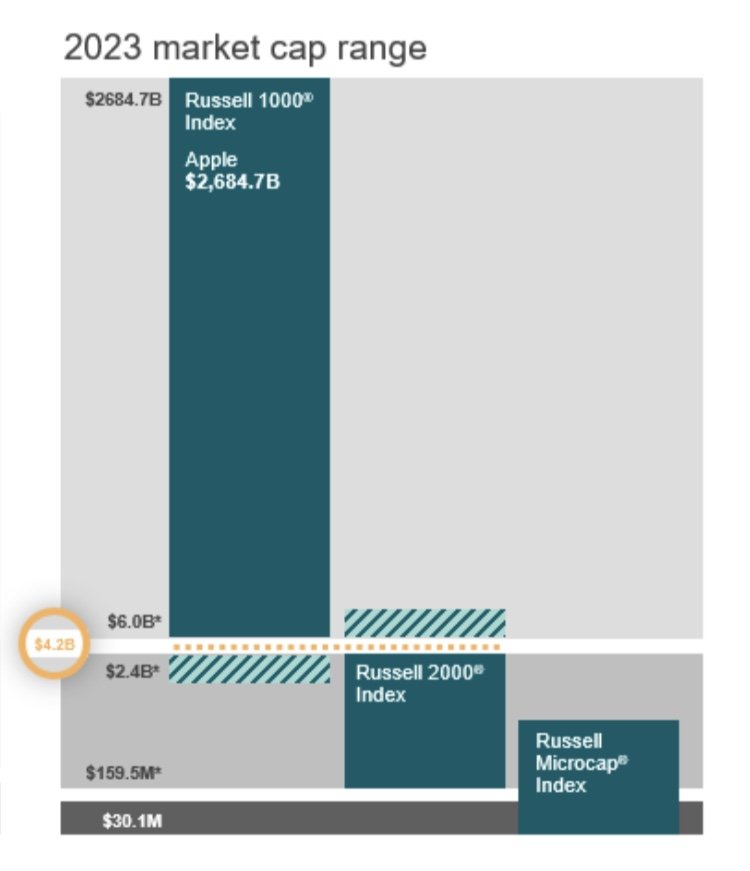

The Russell Reconstitution is an annual rebalancing where U.S. stocks are ranked by market capitalization and redefined within the world’s most widely used equity index. This significant market event creates the highest volume trading day of the year and is considered the Super Bowl of Wallstreet.

A large majority of mutual funds, institutional ETF’s, and government/corporate pension funds are benchmarked to the Russel indexes. Thus, when reconstitution occurs all of these funds must rebalance and adjust many of their stock holdings on this exact day. The stocks newly added to the index will see huge increases in market capitalization as billions of dollars from institutional funds are reallocated to and drive up the price of these stocks.

Investors can take advantage of this event by being appropriately positioned before it occurs. Prior to the yearly reconstitution, FTSE Russell releases a complete listing of additions and deletions to the Russell 3000® Index and Russell Microcap® Index. On May 17th, 2024 this list was posted to their website and any new changes will be publicly addressed in subsequent weeks leading up to the reconstitution date of June 28th, 2024

The most notable index rebalance is the Russell 2000® Index (NYSE: RUT) which represents the US small cap market segment. The stocks added to this index typically see the most dramatic increase in stock price because these companies are generally microcaps that will now have more exposure to institutional funds. Therefore, allocating a portion of your portfolio to a basket of microcap stocks prior to the reconstitution can be lucrative, especially if you are positioned in financially soluble companies.

Outlook

Compared to the broader market, small caps have dramatically underperformed. This is largely due to increased consolidation of the stock market, meaning a majority of the capital is allocated to very few stocks. As fiscal policy reverses, more money is entering all markets and much of this will find its way to smaller companies. Many businesses expected a recession in the past couple years “but this never arrived”. Because so many IPO’s and expansionary measures were put off, this cycle of liquidity could lead to major gains in the stock market. Especially because it’s an election year.

Historically, in periods of high inflation small caps have outperformed large cap stocks and outpaced the rate of inflation. Central banks prompted a 40% increase in the US money supply in the last 3 years. This has created a glut of dollars that must chase assets in a variety of markets. There is a surplus of dollars that must go somewhere. Money (like energy) cannot be destroyed, only transferred.

The ongoing banking crisis caused by dramatic hikes in the Federal Funds rate has caused cash to move dramatically from bank deposits into higher yielding Money Market Funds (MMF). The potential of a recession is dwindling but the strain on the banking sector will require the Federal Reserve to eventually cut rates. This monetary policy coupled with continued inflation will likely lead to environment of cash moving dramatically between asset classes and particularly from MMF’s into cheap small cap stocks.

Trade Strategy

Each investor will have a different strategy in regard to this market event portfolio (long-term vs short-term) & (options vs buy/hold). The companies listed in this portfolio have proven to be financially soluble, growth oriented, and have the potential to be profitable well into the future. Thus, holding these securities for the long term can be lucrative but not required.

The reconstitution event on June 28th, 2024, will affect the market capitalization of ALL stocks in the Russell 2000 Index. The stocks selected in this portfolio have the best chance of sustained growth based on their business model, industry, and financials. These stocks can be traded on a short-term basis and sold on the day of reconstitution or shortly after to take early profits (this is encouraged). However, it is recommended that you only take profit on a fraction of your initial position. This portfolio is designed to follow certain sectors projected to outperform the market over time.

Expect extreme volatility and significant moves in price in either direction due to the high trade volume. Options can be utilized to take larger position, but prudent investors should HEDGE these bets.

The list of 10 stocks below as well as last year’s picks are listed in no particular order. The micro-caps carry a higher risk as well as potential return. The 10 stocks have been chosen based on their industry, growth and financials, all of which is public information. If you are interested in small cap stock index funds, see the 3 tickers below.

Direxion Daily Small Cap Bull ETF (NYSE:TNA)

Vanguard Russell 2000 Index Fund (NYSE:VTWO)

iShares Russel 2000 ETF (NYSE:IWM)

*(Update 6/26/2024) Last year’s portfolio returned over 30% in a single month. As PROMISED, i have made my list of small-cap and MICRO-CAP stocks for this year’s reconstitution